Shipments / My Shipments

Envia Insurance

Envia Insurance is an optional service you can activate when generating your shipping label. It helps you recover part or all of the declared value of your package in case it gets damaged, arrives incomplete, or doesn’t reach its destination.

If you purchase Envia Insurance, you can obtain a refund:

- Up to 100% of the declared value if your package is damaged, arrives incomplete, or is lost.

- You can activate the service with just one click when generating your label.

- The refund applies only if you can prove the value of the contents.

Check our Terms and Conditions for more details

Activation of Envia Insurance

You can purchase Envia Insurance by paying an additional fee to the shipping label price during the checkout process. This amount will be determined based on the declared value of the package and its contents.

Follow these steps when generating your label on Envia.com:

- Log in to your account and click Create guide.

- Complete the origin and destination fields of the shipment.

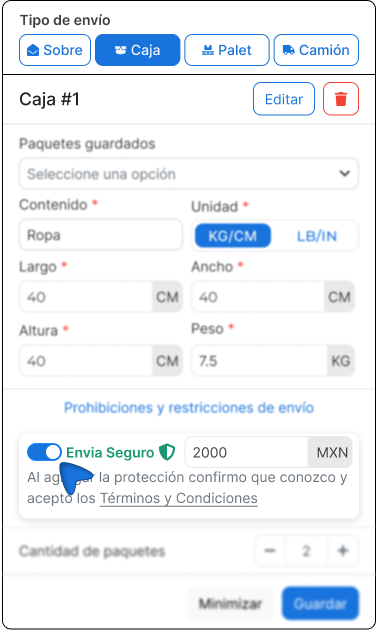

- Enter the dimensions and weight of the package.

- At the bottom, activate the blue switch labeled Envia Insurance.

- Enter the declared value of the contents in your local currency.

- Complete the purchase of the label.

ℹ️ By activating this option, you accept the Terms and Conditions of the compensation service.

Situations covered by Envia Insurance

Envia Insurance coverage applies in the following situations:

- Physical damage to the contents of the package (breakage, dents, spilled liquids).

- Receipt of incomplete packages.

- Total loss of the package due to theft or loss.

Requirements to request a refund

To start the process, you must submit a ticket within the Envia.com platform or send an email with your request to soporte@envia.com.

Depending on the type of incident, you must have:

- A product invoice issued by the SAT or tax authority.

- A sales receipt, purchase note, or other evidence of the real value of your product.

- An official report issued by the carrier in cases of theft, loss, or accidents.

- Customs documentation, when applicable.

Conditions and refund limits

The liability of Envia.com is limited to the declared amount per shipment, with a maximum of $5,000.00 USD (or its equivalent in local currency). The refund amount will be the lower of the declared value and the amount shown on the invoice, excluding VAT or any additional charges.

- Valid sale receipt to the final customer → 90% of the declared value

- Purchase receipt from the supplie → 100% of the declared value

ℹ️ In all cases, a 20% deductible applies to the refund amount.

In cases of partial damage, the following percentages apply:

- Minor aesthetic damage → 25% of the declared value.

- Moderate or functional damage → 50% of the declared value

- Irreparable damage → 100% of the declared value

Steps to report an incident and request the refund

- Check the package upon delivery. If you notice any damage or missing items, take photos and/or videos of the packaging and contents.

- Keep your tracking number and all receipts (product invoice, shipping payment, evidence).

- Go to My Incidents and report an incident See how to create a ticket)

- Fill out the claim form and attach:

- Photos or videos of the damage.

- Tracking number.

- Proof of the product (invoice, receipt).

- Proof of insurance payment.

- An Envia agent will respond within a maximum of 48 business hours.

- If your claim is approved, you’ll receive the refund according to the applicable percentage.

🕐 Time limit: You have 48 business hours 48 business hours after receiving the package to initiate the claim.

🗂️ You have 5 business days to submit all required documentation. If you fail to do so, the case will be closed.

Cases not covered by Envia Insurance

- Items prohibited by the carrier.

- Used, pre-owned, or collectible items that have been handled.

- Electronic devices such as cell phones, tablets, laptops, and computers.

- Specialized medical equipment.

- Products without documentation proving legal entry into the country.

- Packages with insufficient or improper packaging.

- Cases of fraud, deceit, or bad faith by the user.

- Damages or losses resulting from government inspections or customs procedures.

- Official documents or items related to legal or private processes.

Important Notes

- If you do not declare the value of the package or cannot prove it with valid documents, coverage will not apply.

- The refund only applies if the incident is reported within 48 business hours after delivery.

Did you find this resource useful?