Create shipment / International shipments

Taxes, duties and commercial invoice

When you send a parcel abroad, you don't just pay for the transport: the customs of the destination country also charges import duties, taxes and tariffs. This is known as Total import cost. Knowing it and configuring it correctly will help you:

- Avoid surprises of extra charges on delivery.

- Give clear final prices to your customers.

- Reduce delays and customs returns.

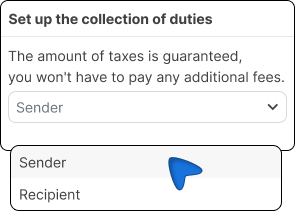

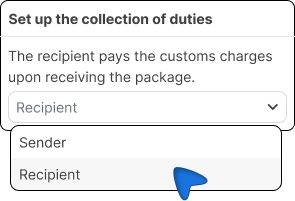

Choose who will pay the taxes

From the drop-down menu choose who pays the customs charges

Shipper (DDP - Delivered Duty Paid). Your customer receives the package without any additional paperwork or payment.

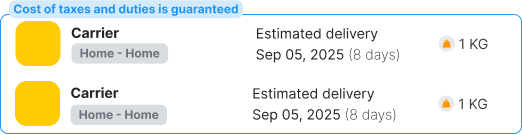

- With guaranteed cost: If you see the message "The cost of taxes and duties is guaranteed.", means that the amount you pay at checkout is the final total with no additional charges at a later date.

- No guaranteed cost: If the guarantee message does not appear, you may receive additional charges at a later date when the carrier sends the invoice with the final tax amount.

ℹ️ The message "The cost of taxes and tariffs is guaranteed."only certain carriers have it, be sure to identify which ones do.

Delivered At Place (DAP)

Your customer pays the taxes upon receipt of the package. The courier charges you before delivery.

Generate waybill and download commercial invoice

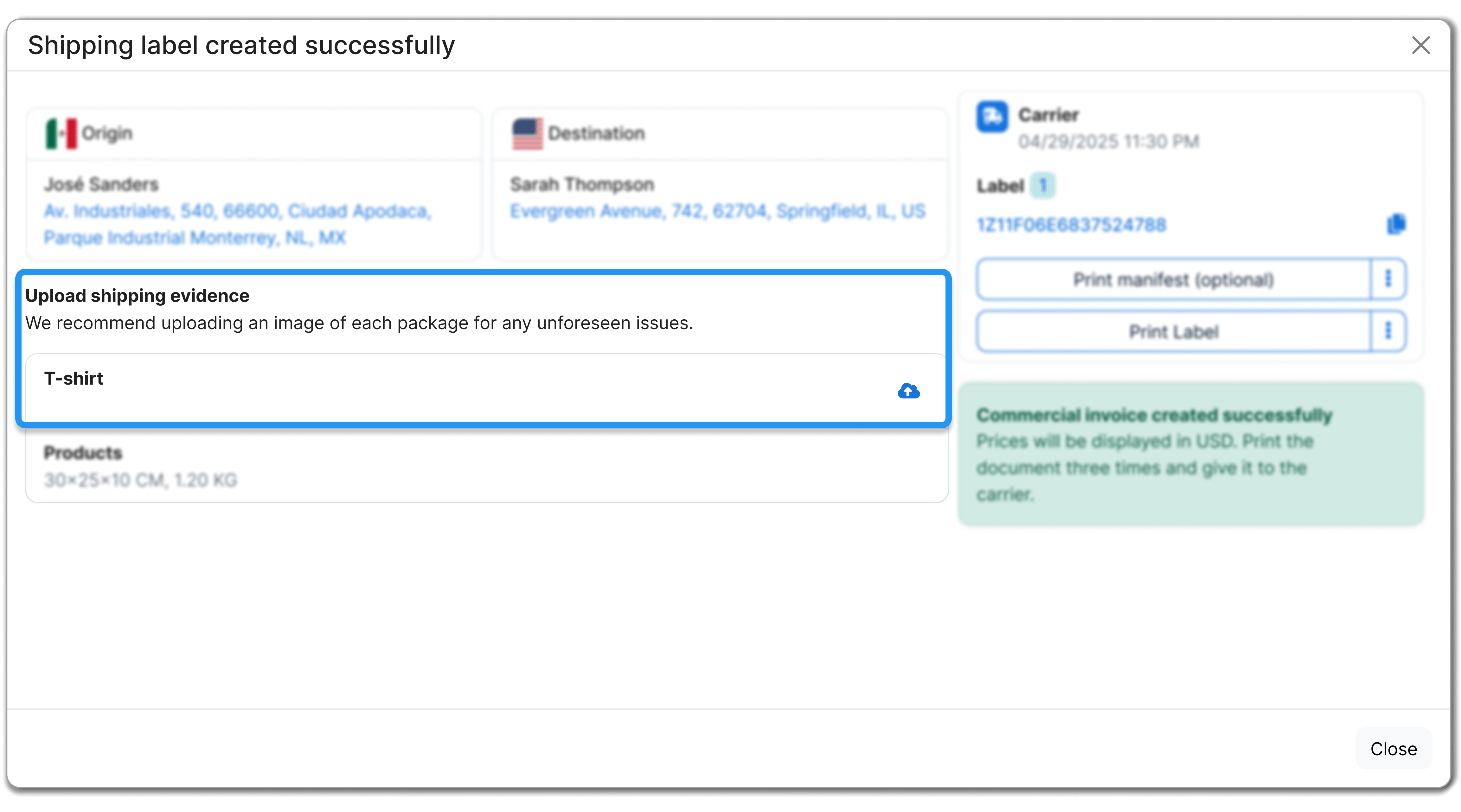

Once you have configured who will pay the duties and taxes (DDP or DAP), check that all the information for your shipment is correct and click on Generate guide.

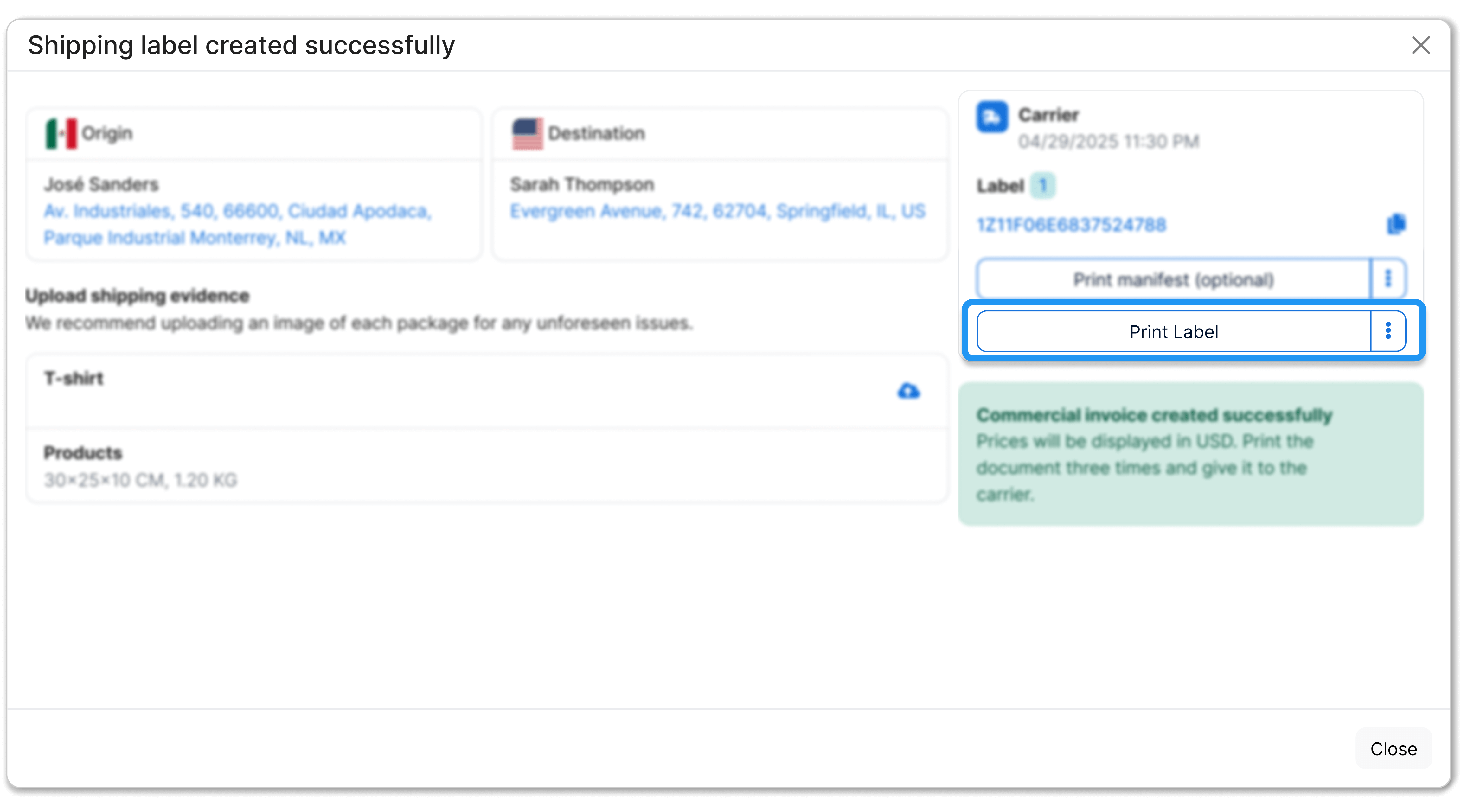

In this screen you will see:

- Confirmation that your guide was successfully created.

- The option of upload evidence of shipment (we recommend uploading a photo of each package as a backup in case of incidents).

- Access to download your shipping guide.

- The notice that your commercial invoice was generated correctly.

ℹ️ We recommend that you upload evidence of the package to help you resolve any claims or unforeseen issues with the parcel.

Download commercial invoice

- Click Print guide in the confirmation of your shipment.

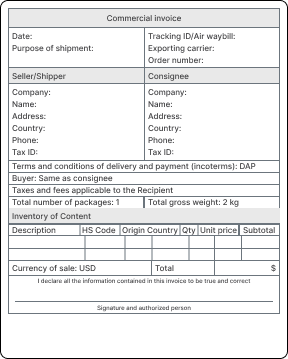

- The system will download a PDF that includes:

- The waybill

- Commercial invoice

- Additional documents (if applicable)

- Print the invoice in three copies and give them to the carrier along with your package.

- Although many destinations use Paperless Trade (PLT) (electronic delivery of the invoice), we recommend that you always submit hard copies.

Commercial invoice is a mandatory document for all international shipments. It is the one that customs checks to calculate taxes and confirm that your package meets import requirements.

Once the guide has been created, it is necessary to download the commercial invoice. This document is mandatory and must be provided to the carrier.

Check that the data are consistent

Customs will compare the commercial invoice with what you declared on the waybill. Make sure they match:

- The declared value must be identical in both documents.

- The description must be in English, clear and detailed.

- The export motive (sale, gift, sample, return, warranty) must match what is selected.

⚠️ If the data does not match, your shipment may be held or returned by customs.

Did you find this resource useful?